FCC increases its Ebitda by 16.6% and reaches 1,529.6 million euros at the end of the 2023 financial year

FCC increases its Ebitda by 16.6% and reaches 1,529.6 million euros at the end of the 2023 financial year

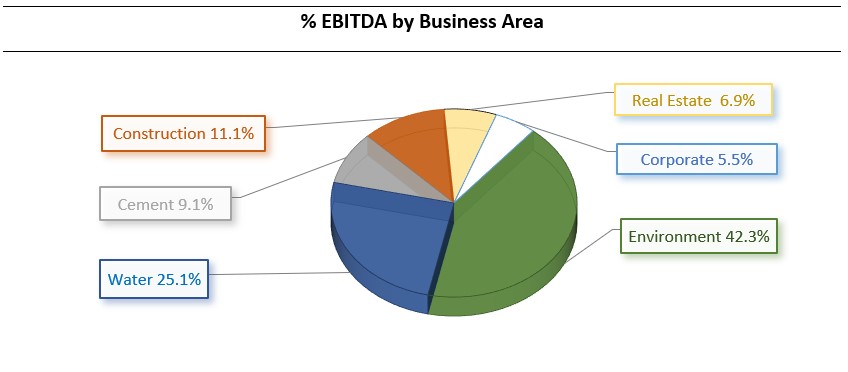

The FCC Group increased its gross operating profit (EBITDA) by 16.6% to 1,529.6 million in 2023, up from 1,311.4 million in 2022, thanks to the stability in the Group's main business areas, with a more significant impact on Cement activity. The consolidated Ebitda operating margin was 16.9%, similar to that obtained last year.

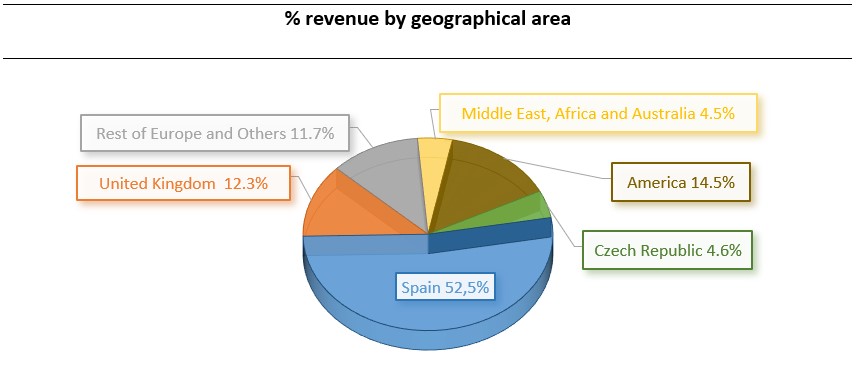

Its turnover rose to 9,026 million euros, 17.1% more than the figure for the previous year. Cement (18.9%) and Construction (43.5%) activities have contributed notably to this growth, followed by a strong increase in the Water area (12.4%).

In addition, its net operating profit (EBIT) soared 49.1% to 910.3 million euros, thanks to the increased EBITDA and the base effect of the 200 million euro adjustment made to the value of property, plant and equipment and the commercial fund in the Cement area in 2022.

The attributable net profit was up by 87.5% to 591 million euros for the business year, thanks to the strong performance in operating profit, in addition to the effect of the consolidation under the equity method of Metrovacesa's holding in the Real Estate area, for an approximate amount of 142.4 million euros.

Furthermore, equity was up significantly in December 2023, standing at 6,145.9 million euros, 24.4% higher than the previous business year, thanks to the higher consolidated profit and the impact of the sale of a 24.99% holding in FCC Medio Ambiente's parent company.

At the end of the 2023 financial year, the FCC Group's net financial debt stood at 3,100.1 million euros, 2.9% lower than in 2022.

The revenue backlog stood at 41,620.8 million euros as at 31 December, with a rise of 3.3% on the previous year end, which is largely down to the notable increase in Water activity.

Operational and contracting milestones

FCC completes sale of 24.99% of the Environment parent company for €965 million

On 31 October, Canadian pension fund CPP Investment completed its acquisition of capital in the Environment parent company, following the agreement reached on 1 June for it to acquire a minority stake of 24.99% for an amount of €965 million. The entry of the new shareholder will enhance the position and strategic development of the subsidiary, its areas and geographical footprint.

The Real Estate area reinforces its competitive position with new acquisitions

Last December, the real estate area, through its parent company FCyC, consolidated its competitive position by investing €178.8 million in the purchase of shares in Metrovacesa and Realia, maximising the value of all its assets and real-estate opportunities. After these acquisitions, reported to the stock market regulator, its participation amounted to 21.19% in Metrovacesa and 66.29% in Realia.

FCC Medio Ambiente consolidates its presence in the waste treatment sector in the United Kingdom, Spain and the USA

Last December, FCC Medio Ambiente agreed to buy out the Urbaser Group's business in the United Kingdom. The enterprise value (including debt and equity) amounts to £398 million. The transaction is expected to be completed in the second quarter of 2024, subject to the satisfaction of certain conditions, customary in this type of transaction. The acquired business in the United Kingdom consists mainly of recycling and waste treatment activities.

In Spain, relevant events included the award to modernise and operate the end-to-end waste management facility in Jerez, serving a population of almost half a million people. The new facilities will increase their recovery capacity and reduce shipment to landfill and are expected to come online in 18 months, with the associated operation contract for a 20-year period and expected revenues of €317 million. Also worth particular mention is street cleaning and municipal solid waste contract for the northern area of the city of Valencia, which was renewed in September for a period of fifteen years, providing a revenue backlog of €486.5 million.

In the United States the strengthening continues, with the award in the county of St. Johns (Florida) of the municipal solid waste collection service for $575 million; with a duration of seven years and two possible five-year extensions, covering a population of 300,000 residents. The planned investments include the acquisition of a fleet of 62 compressed natural gas collection trucks and 13 auxiliary vehicles. Likewise, work continues to expand and modernize the first recycling center in California (Placer County), with an investment of more than 120 million dollars and an operating period of 20 years. The complex will be one of the biggest of its kind, with a treatment capacity of 650,000 tonnes per year. Finally, the renewal of the municipal solid waste collection contract in the western part of Polk County (Florida) is also worth particular mention, with a turnover coming in at almost €140 million over a period of five years and three possible one-year extensions.

FCC Aqualia expands its international activity and seals its entry into the US market

Last December FCC Aqualia entered the US market with the purchase of MDS (Municipal District Services), a company based in Texas, for 81.4 million euros. MDS manages the comprehensive water cycle of more than 360,000 local residents, mostly in the outskirts of Houston, with nearly 140 service contracts in place with different district clients.

In relation to new end-to-end management contracts, worth particular mention is one for the design, construction, rehabilitation and operation of hydraulic infrastructure in Riohacha-La Guajira in Colombia, with a backlog worth €292.7 million for a duration of 30 years, in addition to the other relevant contracts secured in France and Saudi Arabia.

As a result of the increase in water cycle management activity, the backlog at the end of the year grew by 7% and international contracts now account for 68.4% of the total in the water management area.

FCC Construcción secures an important industrial contract in Germany

FCC Industrial, a specialist subsidiary of the Group's construction division, has been awarded, in consortium with other companies, the provisional contract for the construction of a regasification terminal in Germany, the second of its kind in the country, for Hanseatic Energy Hub, with a revenue backlog of €270 million. Likewise, FCC Industrial has also been awarded a contract to build solar facilities in Guillena (Spain), with a total capacity of 263 MW and an investment of 140 million euros.

During the final quarter of the year, worth particular mention is the selection of the consortium led by FCC Construcción to perform works on the new Porto metro line, dubbed Rubi (H), worth more than €379 million. The new line will add 6.3 kilometers to the city's metro network. Furthermore, the joint venture in Spain in which FCC Construction has a holding has been awarded the works for the underground construction of line R2 in Montcada i Reixac (Barcelona) as well as the construction of the new station in this town, for an amount attributable to FCC Construcción of €148.9 million.

In December, FCC completed the voluntary takeover bid for the amortization of its own shares

The Board of Directors meeting held on June 28 announced that an Extraordinary General Shareholders' Meeting would be scheduled for the acquisition of own shares for subsequent redemption, as part of a takeover bid to be formulated by the Company and addressed to FCC shareholders for a maximum of 32,027,600 treasury shares, representing approximately 7% of the company's share capital, at a share price of €12.50. The Extraordinary Shareholder's Meeting, held on 19 July, approved its submission. The CNMV authorized the operation on October 25 and the acceptance period ended on November 30. This saw 4.502% of company's share capital, or 20,560,154 shares, being redeemed. As a result of this operation, the company's share capital at the end of December 2023 stood at 436,106,917 shares.

| KEY FIGURES | |||

| (Millions of euros) | Dec. 23 | Dec. 22 | Chg. (%) |

| Revenue | 9,026.0 | 7,705.7 | 17.1% |

| Gross Operating Profit (EBITDA) | 1,529.6 | 1,311.4 | 16.6% |

| EBITDA Margin | 16.9% | 17.0% | - 0.1 p.p |

| Net Operating Profit (EBIT) | 910.3 | 610.5 | 49.1% |

| EBIT Margin | 10.1% | 7.9% | 2.2 p.p |

| Income attributable to the parent company | 591.0 | 315.2 | 87.5% |

| Equity | 6,145.9 | 4,939.0 | 24.4% |

| Net financial debt | 3,100.1 | 3,192.7 | -2.9% |

| Backlog | 41,620.8 | 40,273.8 | 3.3% |